Hoteliers often find themselves overwhelmed with the constant stream of third-party technology providers vying to serve the complex needs of the B2B transient segment. Digital transformation, accelerated by pandemic-era innovations; travel managers’ increasing preference for end-to-end, tech-enabled interactions; and the growing importance of the small and medium business (SMB) segment all put pressure on hoteliers to curate partnerships with key providers or build solutions themselves.

While hoteliers understand they need third-party technologies, they can’t (and shouldn’t attempt to) partner or engage with all of them. They must distinguish between partnerships that meet the diverse needs of their customers, complement their existing services and increase profits—and the ones that don’t. To do this effectively, hoteliers must understand the value they can provide to their B2B customers—travel managers and travelers. Traditionally, access to inventory (rooms) was the primary value hotels contributed. Yet, as digital-enabled transactions become increasingly the norm, do hotels have a broader role to play in the B2B transient segment journey? If so, how can they determine what additional value they can provide?

As more third parties insert themselves in the B2B transient journey, hotels are pushed farther away from their B2B customers and B2B travelers. Without a change in strategy, hotels could easily become just another commodity in the eyes of this valuable segment.

In this article, we explore the evolution that has occurred within the B2B transient tech industry and how industry shifts have affected the evolving needs of travel managers. We provide an overview of the technology trends shaping the B2B transient travel sector and explain their significance. We offer a framework for evaluating third-party technologies, grounded in an understanding of customer needs, and share four emerging trends hoteliers should keep an eye on in 2024 and beyond.

How we got here: Understanding how B2B transient tech has evolved over time

Three major evolutions transformed the B2B transient tech ecosystem:

1960s-1980s: Emergence of global distribution systems. The emergence of global distribution systems provided expanded access to airline inventory for travel agents and facilitated a more efficient ticket booking process. While originally focused on airline tickets, hotels quickly followed suit. As a result, travel management companies (TMC) were able to offer more holistic services for corporate travel programs, elevating their role in the B2B transient journey.

- Travel management needs met

- Consolidated supply on centralized platforms

- Streamlined workflows and reduced time-to-ticket confirmation

- Delivery of centralized value through the TMC

- Travel management needs exposed

- Desire for expanded access to supply

1990s-2000s: Rise of the online travel agency (OTA). Online supply distribution in an age of internet accessibility accelerated the growth of OTAs with an initial focus on leisure travel and eventual growth with SMBs. These platforms allowed consumers to compare all hotels in the market on both price and amenities easily for the first time, so they could be sure they were finding the best value in the market.

- Travel management needs met

- Simplified access to and increased transparency of inventory availability and prices across markets

- Measurable cost savings for travel programs

- Travel management needs exposed

- Track traveler bookings across channels

- Ways to reduce leakage and maintain agency of record

2000s-present: Offering fragmentation and push toward direct booking. Technology advances have led to expanded distribution channels. Third parties began to form strategic partnerships, and hotel brands are emphasizing direct booking and improved customer experiences.

- Travel management needs met

- Improved data capture for on- and off-channel bookings

- Travel management needs exposed

- Ways to maintain agency of record and duty of care

Where we are: Recent shifts in the B2B transient tech ecosystem

Despite the opportunities a dynamic landscape creates, the B2B transient tech ecosystem presents meaningful challenges for hoteliers. The marketplace is crowded with more than 250 companies vying for attention. An abundance of players leads to complexity for hoteliers, travel managers and travelers alike. Technological advancements fueled a proliferation of offerings, blurring traditional company distinctions and intensifying competition.

A few trends in the B2B transient tech ecosystem stand out:

- Exponential growth: The number of new solutions has increased exponentially, amplifying decision fatigue for the parties involved. Identifying the best partnership opportunities requires time for due diligence, and we all know time is our most scarce resource.

- Emphasis on value: Among new entrants, we see an increased focus on driving value beyond access to inventory. While hoteliers traditionally engaged with partners who can provide access to travelers they can’t reach on their own, new solutions are focused on other forms of value: data aggregation, insights and efficiencies.

- A broader focus on partnership: Third parties recognize creating value lies not in solving a single problem but rather in simultaneously solving multiple problems, and therefore improving the end-to-end journey for customers through digital enablement. The many distribution, connectivity and expense management solutions, among others, are increasingly partnering or merging to streamline solutions for B2B transient travel managers.

The large number of providers in the modern B2B transient tech landscape makes two things clear: B2B transient customers are looking for more—and different—value and to maintain relevance, hoteliers must expand their thinking about where they fit within the ecosystem.

How we’ll get where we’re going: Knowing your B2B customers creates a strategic advantage

Hoteliers need to continue creating value for their customers, in this case, travelers and travel managers—or risk being commoditized as third parties continue to insert themselves into these critical business relationships. Decision-makers at large corporate customers and SMBs alike vote with their budgets and their data. These customers ultimately set the direction of the B2B transient tech ecosystem through their choices, which are driven by critical, unmet needs. The intermediaries they choose to work with set the direction of the broader tech ecosystem to enable those choices.

To participate in the process actively and effectively rather than let others take control, hoteliers must take the time to understand their large corporate and SMB customers’ core needs and pain points. They can then proactively partner or create solutions. For example, the desire for streamlined journeys is a major need for travelers and travel managers alike. How can hotels provide frictionless experiences from RFP processes through search and booking and post-travel processes?

To understand their customers, hoteliers must speak with them. Take the time to engage with travel managers and decision-makers at large corporates and SMBs. Ask three key questions: What problems do they currently have in their travel management process? How are they currently solving those problems? With which solutions are they dissatisfied?

Ultimately, hoteliers can begin to recognize when their objectives align with customers’ unmet needs—the areas where hoteliers can create outsized value and remain indispensable by investing in or partnering with the right third-party solutions.

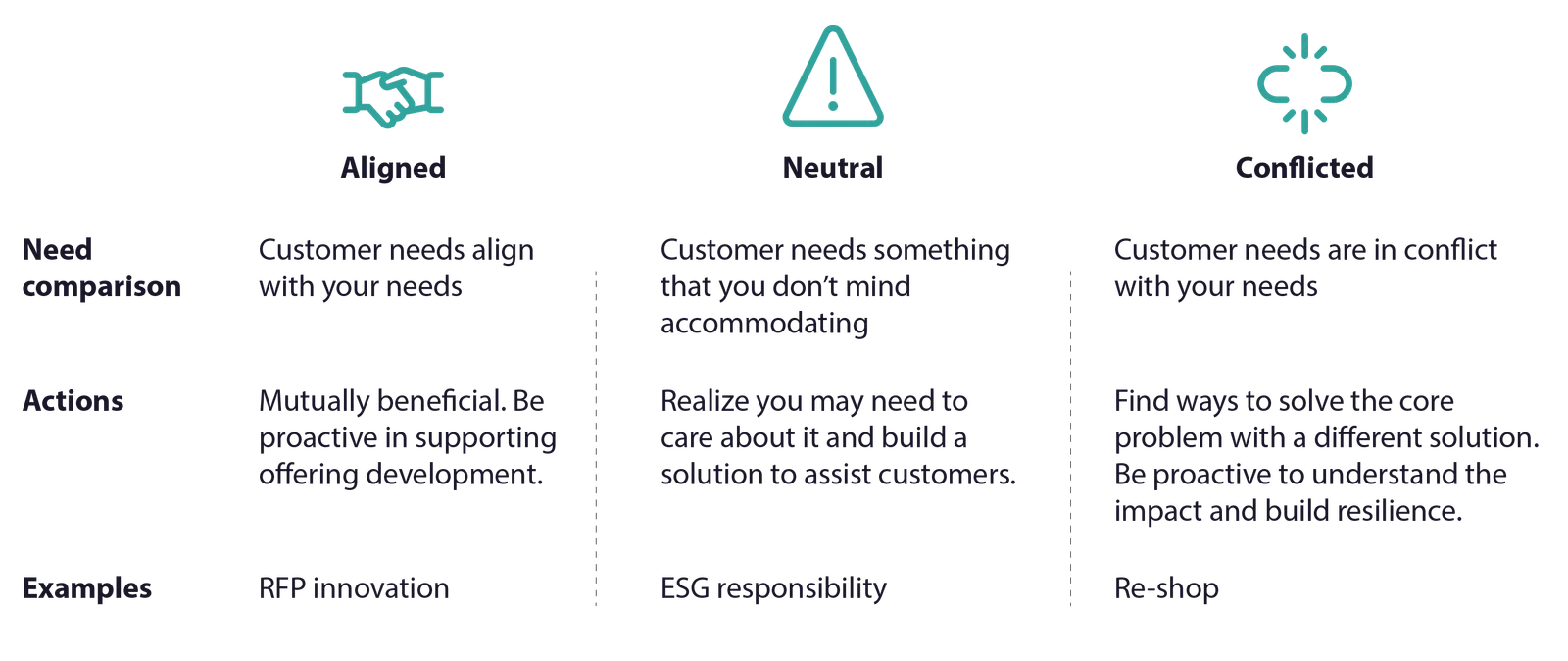

The assessment framework in Figure 1 provides a useful categorization for traveler needs and a method for understanding how to best respond. While justifying investment to support “aligned” needs is easy, hoteliers should consider meeting “neutral” needs they don’t mind accommodating but have outsized value to customers. Finally, hoteliers must proactively focus on understanding customer needs that directly conflict with their needs so they can preemptively identify strategies that mitigate the potential impact of the solutions provided by third parties.

FIGURE 1: An assessment framework helps hoteliers prioritize how to align their needs with customer expectations.

4 B2B transient tech trends to watch out for

We see four key trends emerging in the evolution of the B2B transient tech ecosystem that hoteliers should keep an eye on, each with a focus on meeting customer needs.

Simplicity and streamlining. As travel managers continue to seek simplicity and as SMB needs are more heavily considered by the ecosystem, B2B players will continue to partner and consolidate to modernize processes. This is tipping the balance of power toward certain players that can provide all-in-one solutions.

Distribution channel consolidation. Similar to the consolidation of OTAs on the B2C side, in the B2B space, larger players eventually will acquire the smaller ones, leaving market share to a handful of players.

Data-driven decision-making. As customers continue to use data to build their confidence around actions, companies that can provide this data will grow in esteem and value. We'll start to see more data-as-a-service and monetization of data in the ecosystem.

Loyalty program transformation. While hotel-branded loyalty programs have been decision-drivers for individual travelers for years, more aggregators such as OTAs and banks are developing their own approach to loyalty and broader traveler value. Loyalty to all is loyalty to none. Eventually the best value proposition will win.

Brace for B2B transient tech turbulence and prepare for blue skies ahead

Companies that embrace innovation and collaboration position themselves as leaders in meeting customer needs. Success hinges on staying attuned to customer preferences and proactively addressing emerging challenges in an ever-evolving ecosystem.

This study was commissioned by the American Hotel & Lodging Association (AHLA). ZS and AHLA partnered on the collection and interpretation of the study results